Mastercard Payment Insured 50% Trip Cost

Mastercard often includes travel insurance as a valuable benefit, provided certain conditions are met. This benefit can be a convenient safeguard for tourists and travelers, offering coverage for trip-related issues when specific spending criteria are fulfilled.

For example, many cards such as DNB's Pluss Mastercard and the CIBC Aventura World Mastercard offer comprehensive travel insurance if at least 50% of the trip’s cost is paid using the card.

This insurance can cover various situations such as trip cancellations, interruptions, and baggage delays.

Key Coverage and Benefits:

Travel Insurance Coverage: This typically includes protection against trip cancellations and interruptions, as well as emergency medical expenses.

For instance, the CIBC Aventura World Mastercard provides coverage up to $1,500 per insured person and a combined maximum of $5,000 per trip for cancellation or interruption.

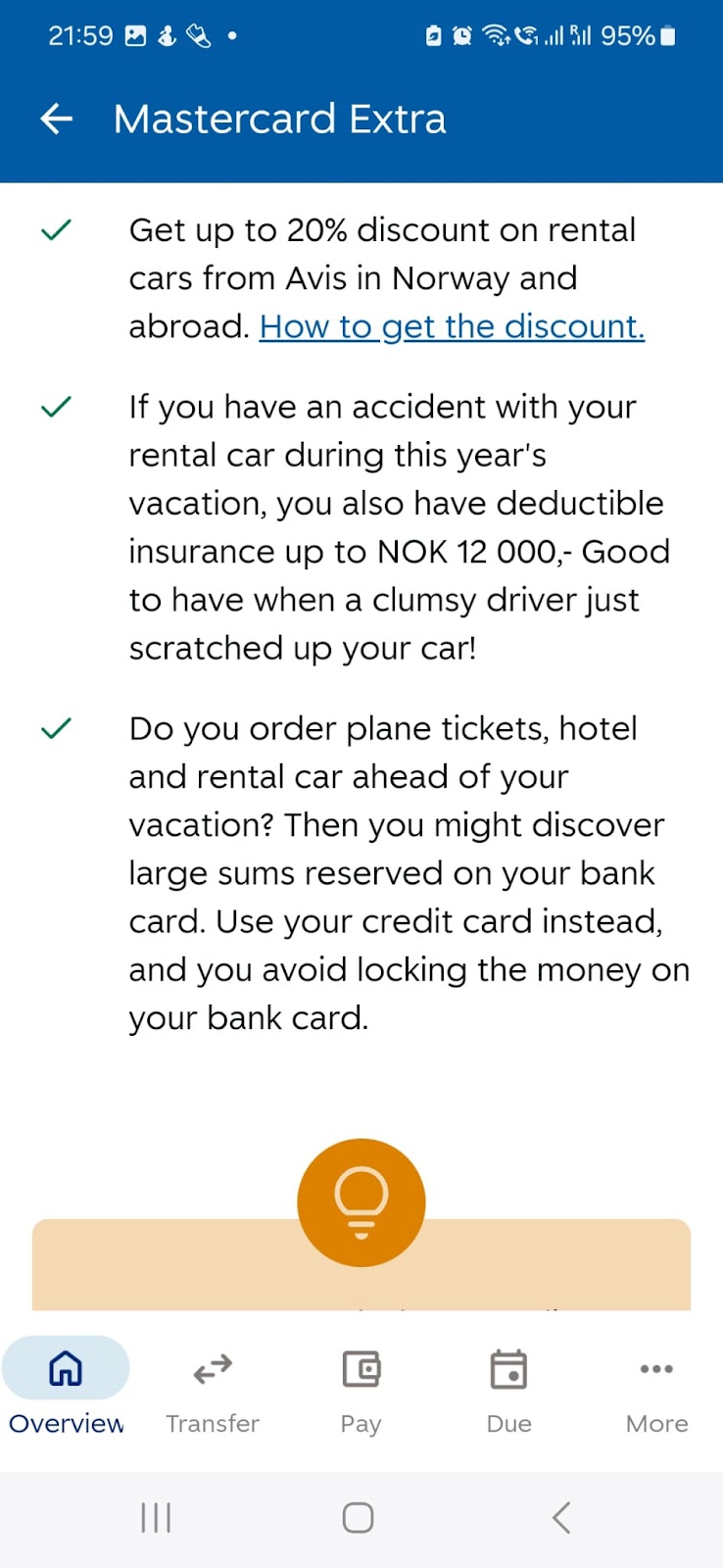

Additional Protections: Many Mastercard offerings extend beyond standard travel coverage to include benefits such as car rental collision damage waivers when the rental is paid with the card, provided the rental company’s insurance is declined.

Additionally, some cards may cover flight delays, lost or delayed baggage, and emergency repatriation.

Activation and Conditions: To activate these benefits, cardholders generally need to pay at least 50% of the travel expenses, which might include transportation and accommodations, with their Mastercard.

Limitations and Exclusions: The specifics of coverage, including maximum coverage limits, eligibility conditions, and excluded circumstances, depend on the type of Mastercard and the issuing bank (e.g., Standard, Platinum, World, or World Elite).

Common exclusions can include pre-existing medical conditions and risky activities, which may void certain coverage provisions.

Always review the detailed terms in the cardholder’s agreement or benefits guide to understand fully the conditions and limitations.

Important Steps for Tourists:

Consult Your Provider: Each bank or card issuer can have different terms attached to the travel insurance they offer.

Contact your card provider or refer to their online benefits guide for the most accurate and current information.

Review Your Coverage: Make sure to check for any special clauses or required actions, like pre-trip notifications or reporting protocols in case of a claim.

Plan Accordingly: Know the types of incidents your insurance will cover, such as medical emergencies, trip cancellations, or property loss, so you can travel with greater peace of mind.

Thus, while Mastercard travel insurance can be a reliable resource for travelers, cardholders should carefully verify their specific card's terms to avoid surprises.

This proactive approach ensures comprehensive planning and confidence during trips.

Comments

Post a Comment